Zensar reports PAT at 7.4% in Q1FY21 An increase of 5.5% QoQ in INR terms

Press Release | 23 Jul 2020

Pune, India, July 23, 2020: Zensar, a digital solutions and technology services company that specialises in partnering with global organisations on their digital transformation journey, announced its consolidated financial results for Quarter ending June 30, 2020, of the fiscal year 2020-2021.

Financial Highlights:

-

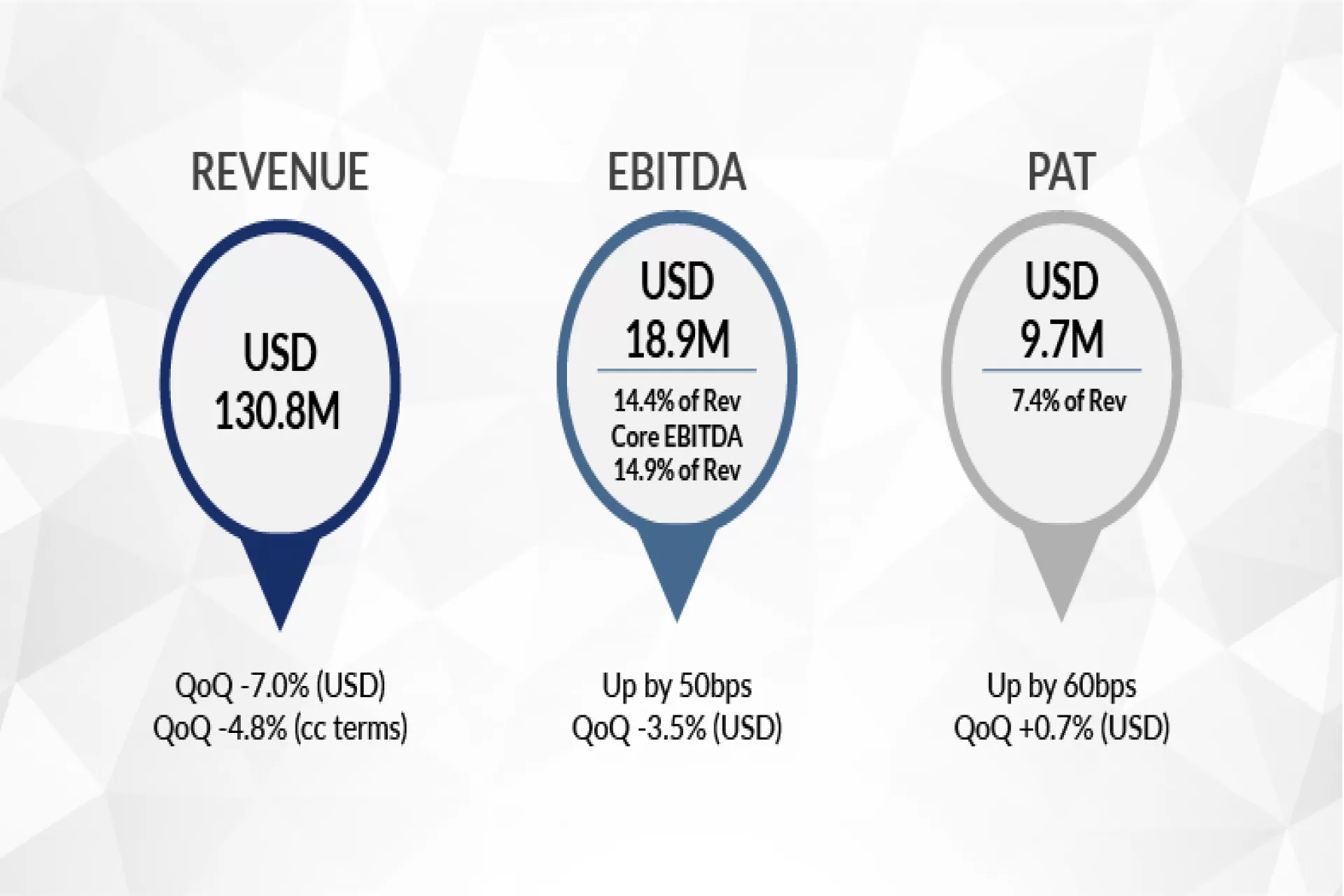

In Q1FY21, the Company reported revenue of $130.8Mn

-

In Q1FY21, the Company reported a PAT of $9.7Mn

-

EBITDA increased from 13.9% in Q4FY20 to 14.4% in Q1FY21

-

DSO reduced by 12 days and net cash is $101.1Mn

Sandeep Kishore, Chief Executive Officer and Managing Director, Zensar Technologies, said, “In Q1FY21, we have continued our focus to ensure wellness and safety of all our people and to support all our global clients in their Digital, Cloud and IT systems as the world deals with the pandemic. We have invested into launching several new propositions tailored to help our customers remain relevant during and post the pandemic period. Our Digital Foundation Services has performed very well, posting a QoQ growth of 7.6% and our hi-tech business grew by 2.9% QoQ.”

“In Q1FY21 we won $150Mn TCV deals demonstrating the robustness of our new propositions aligned to Digital Foundation and Digital Applications. Our current pipeline is at $1.5Bn. Our global talent has been very productive, in the new 100% remote model working closely with our customers as they embark on transformation path to recovery and resilience,” he further added.

Navneet Khandelwal, Chief Financial Officer, Zensar Technologies said, In Q1FY21, we continued our cash management initiatives and our rigour on collections. This has resulted in an improvement on our cash conversion or DSO by 12 days sequentially and an increase in our net cash position by $41.3Mn sequentially. Our focus on operational efficiencies has resulted in an increase in EBITDA despite decline in revenues to 14.4%. Our PAT is at 7.4% of revenue which is an increase from 6.8% in Q4FY20.”

Significant Wins in Q1FY21:

-

Cloud and infrastructure mandate for a large American pharmaceutical company

-

Application and development mandate for a leading American hi-tech company

-

Application and services mandate for a global internet entity

-

Financial services application for a leading conglomerate in banking and financial services segment in South Africa

Corporate Excellence Q1FY21:

-

Zensar recognized as an ‘Aspirant’ in BFS Risk and Compliance IT Services Everest PEAK Matrix® Assessment 2020

-

Zensar recognized as an ‘Aspirant’ in Open Banking IT Services in Everest Peak Matrix Assessment™ 2020.

-

Zensar positioned as a ‘Major Contender’ in Guidewire Services Everest PEAK Matrix® Assessment 2020

-

Zensar named Niche Player in the 2020 Gartner Magic Quadrant for Data Center Outsourcing and Hybrid Infrastructure Managed Services, North America

-

Zensar named Niche Player in the 2020 Gartner Magic Quadrant for Managed Mobility Services, Global

-

Zensar’ s ZERF gets an outstanding recognition by Analyst Rena Bhattacharyya, Service Director - Enterprise Technology and Services at GlobalData

-

Zensar Case studies mentioned in ISG Digital Case Study Book

-

HFS HIGHLIGHT: ZENSAR INTRODUCES, ZENTRUST AND ZENCARE TO HELP CLIENTS THROUGH COVID-19, Ollie O’Donoghue

-

Zensar has been mention as an Aspirants in Salesforce Peak Matrix 2020

-

Zensar has been mentioned in Gartner Digital Commerce Vendor Guide,

2020 -

Zensar mentioned as a Contender in Everest Guidewire Services PEAK Matrix® Assessment 2020 – Setting the Stage for Core on Cloud

Q1 FY 21 Revenue and profitability snapshot

|

Particulars |

Q1 FY21 |

Growth |

||||||

|

USD Mn |

INR Cr |

Q-o-Q |

Y-o-Y |

|||||

|

USD |

INR |

CC |

USD |

INR |

CC |

|||

|

Revenue |

$ 130.8 |

₹ 9912 |

(7.0%) |

(2.6%) |

(4.8%) |

(14.7% |

(7.0%) |

(12.1%) |

|

EBITDA |

$ 18.9 |

₹ 1430 |

(3.5%) |

(1.0%) |

|

(13.4%) |

(5.6%) |

|

|

EBIT |

$ 13.0 |

₹ 987 |

(5.9%) |

(1.4%) |

|

(20.3%) |

(13.2%) |

|

|

PAT |

$ 9.7 |

₹ 733 |

(0.7%) |

(5.5%) |

|

(14.5%) |

(6.9%) |

|