Two-pot Retirement System: Financial Security and Flexibility for South Africans

The South African government has proposed a new 'two-pot' retirement system to improve financial security and flexibility for individuals. The system aims to address issues with the current retirement system, such as limited access to funds in times of economic distress – an issue highlighted during the COVID-19 pandemic, and low levels of preservation before retirement.

Key features of the two-pot system

- New contributions: New contributions will be divided between two pots - a 'savings pot' and a 'retirement pot.'

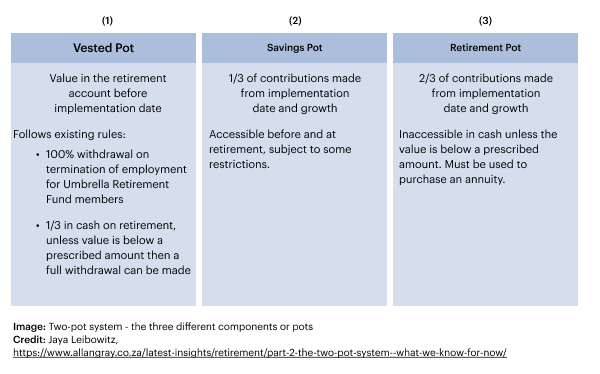

- Existing retirement fund savings: Existing retirement fund savings will continue to accumulate in a ‘vested pot.’

- Impact on provident fund members aged 55 and older: These members will be exempted from the two-pot system by default but can choose to opt in.

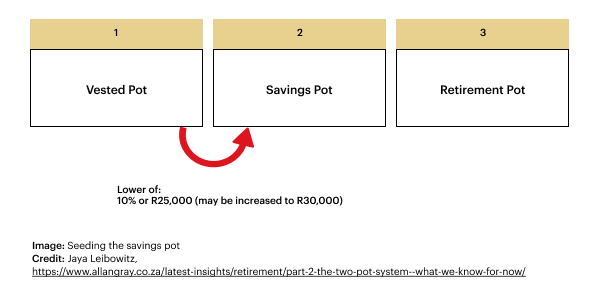

- Immediate accessibility to funds: A portion of the money in the ‘vested pot’ will be transferred to seed the ‘savings pot.’

The proposed two-pot system aims to enhance retirement security and flexibility by addressing these key areas, ensuring that individuals have adequate savings and support throughout their retirement journey.

- New contributions: Split between the 'savings' and the ‘retirement’ pot

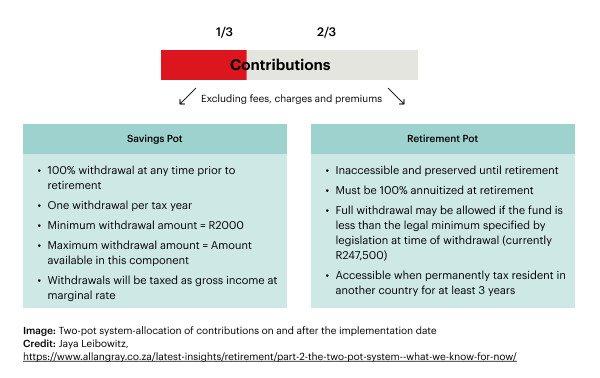

Under the proposed two-pot retirement system, all contributions to provident, pension, and retirement annuity funds will be divided into two parts. One-third of the contributions will be allocated to a 'savings pot,' while the remaining two-thirds will be credited to a 'retirement pot.’ The accompanying image illustrates this.

The 'savings pot' allows individuals to handle unexpected expenses or emergencies without jeopardizing their retirement savings, while the 'retirement pot' ensures a guaranteed retirement income source. - Existing retirement fund savings: Essentially, there are three pots

Contributions made until the implementation date and all growth on those contributions will remain in the existing or ’vested pot‘ as illustrated in the image below. These contributions will be subject to all the rules and entitlements that apply today.

- Provident fund members who were 55 and older on March 1, 2021: Excluded from two-pot by default

Members of provident funds aged 55 or older on March 1, 2021, with vested rights, can opt in or out of the two-pot system. According to the National Treasury's latest draft response, these members are excluded by default (i.e., opt-out) but can opt in. If the member chooses to opt out, the contributions will continue to be credited to the vested component, and current rules will apply. - Seeding the savings pot: Immediate accessibility explained

To provide immediate cash access, 10 percent of the vested component, up to R25,000 (or R30,000 based on the National Treasury’s latest proposal), will be automatically transferred to the savings pot on the implementation date.

Some members, such as provident fund members who were 55 and older on March 1, 2021, and chose not to participate in the two-pot system and certain retirement funds, may be excluded from this transfer, but the list is still to be confirmed.

Implementation schedule and challenges: Proposed date and potential issues

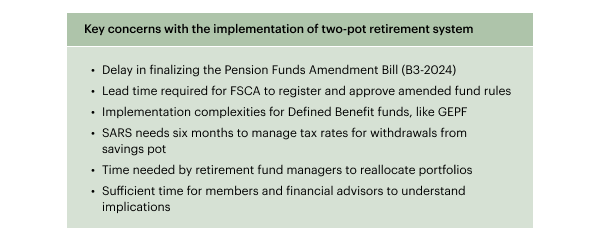

According to the latest information, the Standing Committee on Finance (SCoF) has agreed to extend the implementation date of the two-pot system contained in the Revenue Laws Amendment Bill (the RLAB) from March 1, 2024 to September 1, 2024.

However, major stakeholders, including the government, the National Assembly, the Financial Sector Conduct Authority (FSCA), the Trade Union Federation (COSATU), the financial services industry, and various governing bodies, recognize significant challenges that must be addressed before implementation.

In his letter to the Chairperson of the SCoF, the Finance Minister, Mr. Enoch Godongwana, raised the following concerns with the March 1, 2024 implementation date:

Pension Funds Amendment Bill delays two-pot system implementation

Amendments to retirement fund rules to accommodate the two-pot system can only proceed once the Pension Funds Amendment Bill is implemented. The Bill was submitted to Parliament on January 30, 2024. Although the Bill was expected to be finalized by the end of March 2024, the schedule has changed.

The three-month approval process for fund amendments impacts 1300 retirement funds and their members

Around 1300 active retirement funds must submit their amended rules to the Financial Sector Conduct Authority (FSCA) for registration and approval. Funds are also required to communicate any changes and their impact to members. According to the Finance Minister, this process is expected to take at least three months to complete.

SARS: Six months needed to implement the new tax system to handle two-pot

SARS has stated that a six-month period is necessary after the legislation's promulgation to establish a system for managing tax rates on withdrawals from the new 'savings pot.' SARS has warned that rushing this process could lead to incorrect tax calculations, causing financial hardships and liabilities for members at the end of the tax year.

Hurried implementation could disrupt retirement funds and the market

A hurried implementation could lead to a rushed reallocation of retirement fund portfolios, potentially impacting the market. The finance ministry has stressed the importance of allowing members and financial advisors time to understand the new system to avoid compromising their financial security in retirement.

Defined Benefit funds pose a significant challenge

The two-pot system's implementation is particularly complex for Defined Benefit funds (DB funds), like the Government Employees Pension Fund (GEPF), which has over 1.2 million members. Unlike Defined Contribution funds, DB funds determine benefits based on factors like final salary and years of service. The Retirement Laws Amendment Bill (RLAB) allows DB funds' savings and retirement components to be determined based on pensionable service from March 1, 2025, or a method approved by the FSCA. Careful implementation is crucial to ensure fairness for all members, and additional time may be required for DB fund administrators to engage with the FSCA.

Preparing for change: Retirement services industry gears up for two-pot system

The South African retirement services industry is thorough in its impact assessment of the new two-pot system, building internal capabilities around people, processes, and technology to ensure a smooth transition.

According to a leading retirement services provider, approximately 300,000 members will be eligible to access their savings pot on day one of the transition to the two-pot system. This is a significant increase in claim volume compared to the 70,000 claims processed in 2022. To manage this change, organizations are focusing on engagement across all stakeholders, including members, employers, trustees, fund managers, financial advisors, and brokers. Key aspects of this engagement include:

- People engagement: Organizations update their systems with member contact information and establish multiple communication channels to educate stakeholders on the changes, enabling informed decision-making.

- Process and technology enablement: Organizations are leveraging digital technologies to simplify the claim process, enable self-service, and provide guidance to members.

By prioritizing engagement and digital transformation, organizations aim to ensure a smooth transition to the two-pot system while effectively managing the anticipated surge in claim volumes.

We at Zensar, a trusted IT services provider to the South African retirement services industry, are engaged through our experience-led engineering services, deep domain knowledge, and quality assurance capabilities to enable a smooth transition to the new two-pot retirement system.

References

1) National Treasury, Republic of South Africa

2) Allan Gray, South Africa

3) Old Mutual, South Africa

4) Ina Opperman, The Citizen