In today’s digital economy, data is the new currency — but its true value emerges only when businesses can blend technology, governance, and intelligence to deliver measurable outcomes. At this intersection, Zensar, in partnership with Databricks, is redefining how insurers unlock insights, accelerate transformation, and future-proof their operations.

Why this matters: The insurance imperative

Insurance organizations face unique challenges:

- Infrastructure: Platforms such as Guidewire offer robust policy and claims management, but integrating them with modern analytics and AI ecosystems is complex.

- Data silos and latency: Fragmented data across underwriting, claims, and customer engagement slows decision-making.

- Regulatory pressures: Compliance frameworks demand transparency and governance without sacrificing agility.

Enter ZenseAI.Data: Accelerator for insurance

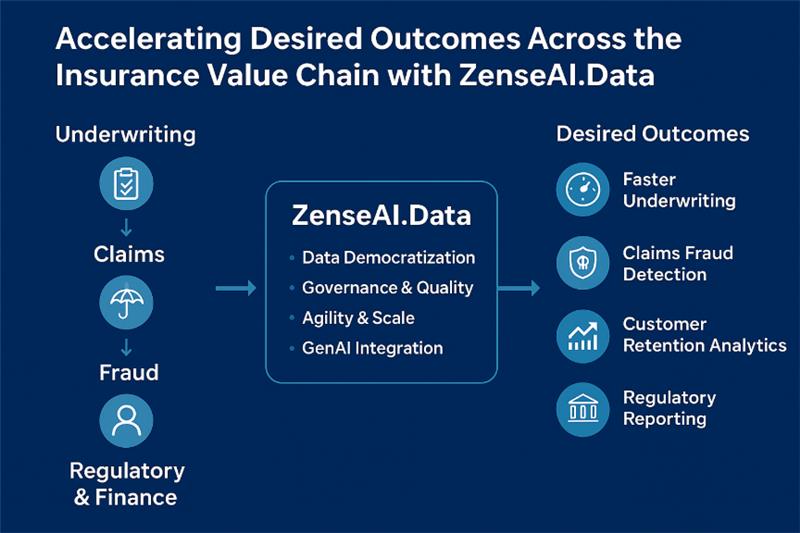

ZenseAI.Data is Zensar’s flagship accelerator designed to fast-track data transformation. It enables:

- Data democratization

- Governance and quality

- Agility and scale

- Gen AI integration

Mapped to the insurance value chain, ZenseAI.Data delivers outcomes such as:

✔ Faster underwriting

✔ Claims fraud detection

✔ Customer retention analytics

✔ Regulatory reporting

Legacy migration made simple

Insurers often rely on legacy systems — SAS, SSIS, Ab Initio, SAP, Oracle, Cloudera, Informatica, Netezza, Teradata — that hinder agility. Zensar’s modernization approach:

- Automates ETL rationalization and data pipeline migration to cloud-native platforms

- Leverages Databricks Lakehouse architecture for unified analytics

- Ensures minimal disruption with metadata-driven ingestion frameworks

Why Zensar? Small enough to care, large enough to cater

- Deep Insurance Expertise

- Verticalized Solutions

- Global Delivery Model

- Gen AI Leadership

Business impact in action

- 40% faster data ingestion and 50% report rationalization for a leading insurer migrating to Guidewire Cloud.

- 50% improvement in data quality for a pan-African insurer using Zensar’s iDQ solution.

- 30% reduction in report development efforts and 30% lower maintenance costs for a global insurance client.

The future: Data intelligence + Gen AI

With Databricks Lakehouse and ZenseAI.Data, insurers can:

- Move from reactive reporting to predictive and prescriptive insights.

- Deploy GenAI-powered agents for underwriting, claims, and customer engagement.

- Achieve faster go-to-market for new products and personalized offerings.

Ready to transform your insurance data strategy? Learn more:

https://www.zensar.com/tech-services/artificial-intelligence/zenseai/zenseaidata